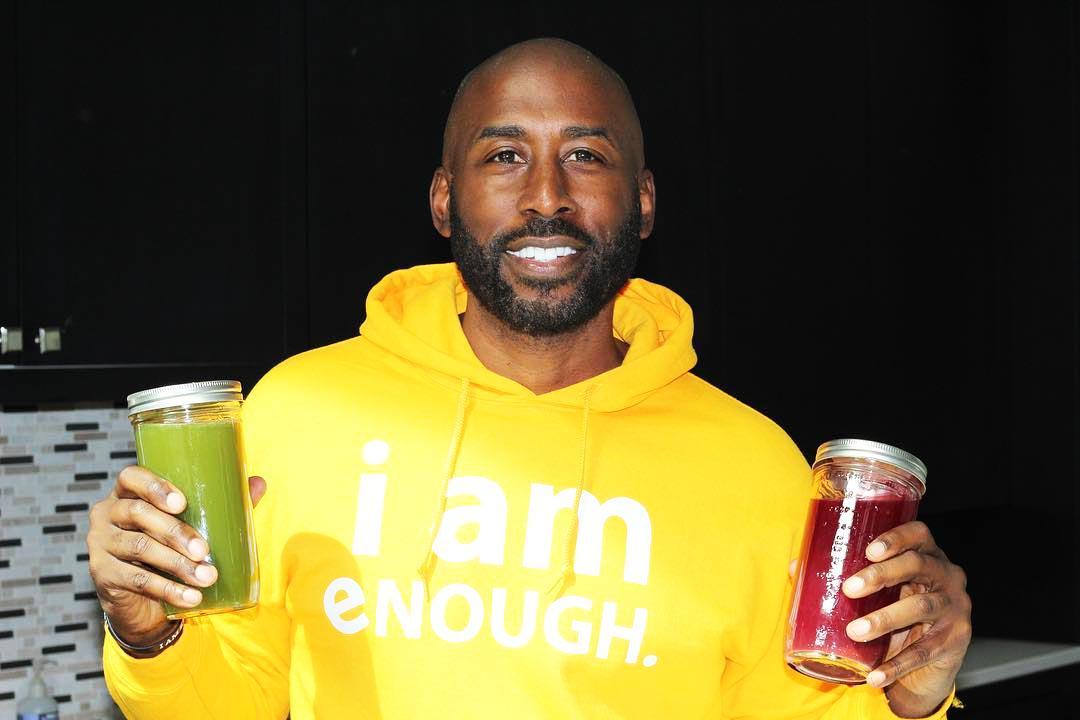

Jayson Thornton, CFP is an African American Certified Financial Planner and Advisor who also hosts a call-in financial talk show. Below he reveals four things that people should be doing to prepare themselves for a recession:

1. Build up your savings

An emergency savings fund is a foundational building block for any good personal financial plan. A sufficient emergency savings fund is three to six months of your household expenses. Remember: These are your needs and not your wants. Saving cash is not a sexy move to make with your money, but it is the first thing you must do.

Liquidating retirement accounts and paying for personal expenses on credit cards can set back your financial goals for years. I advise my clients to prioritize building up their savings. The emergency savings fund can protect their retirement plans during a recession.

2. Pay down debt

Surviving a recession requires disciplined budgeting. Now is the best time to pay down or pay off debt. This will give your budget the room and flexibility needed to meet the new demand caused by rising prices and decreasing wages.

Paying down debt now will help keep you from destroying your credit score and going even deeper into debt when debt payments are missed in order to keep current with monthly essential payments.

3. Don’t exit the market

Our economy goes through seasons; we have cycles of ups and downs. During a recession, far too many people get spooked and sell off their investments too early. Investing comes with inherent risk, but needlessly liquidating your retirement or other investment accounts can damage your financial plan for years.

If you are not nearing retirement, a down market is not a setback. You can take advantage of lower market prices if you are dollar-cost averaging. If you are near retirement, you should be contacting a financial planner to help you rebalance your portfolio to minimize your exposure to the coming recession.

4. Get or update advanced job training

Getting advanced job training before a recession is like putting on armor before a battle. As the economy slows down, the job market gets more competitive. Workers with a higher skill set have better odds of not being laid off and they are more likely to find new employment.

Advanced training opportunities do not have to be expensive, they can be found at junior colleges, trade schools, and through low-cost certifications

The key to a recession-proof financial plan is avoiding hype. Contact a Certified Financial Planner and follow the recommendations no matter how boring they may seem.

About

Jayson Thornton, CFP is the founder of Thornton Advisor Group and host of Pocket Watching with JT which gives away free money tips on a call-in financial talk show on YouTube. Learn more about him at his official web site at PocketWatcher.net